Intel Corp. canceled a deal to buy Israeli chip maker Tower Semiconductor Ltd. for $5.4 billion after failing to get timely approval from a Chinese regulator.

Intel promised to pay Tower Semiconductor $353 million for canceling the transaction, Reuters reported.

The two companies announced the deal in February 2022. Initially, they planned to close it within 12 months, but then postponed the completion date more than once. Western media reported that Intel may cancel the deal because it has not received the proper approval from Chinese regulators.

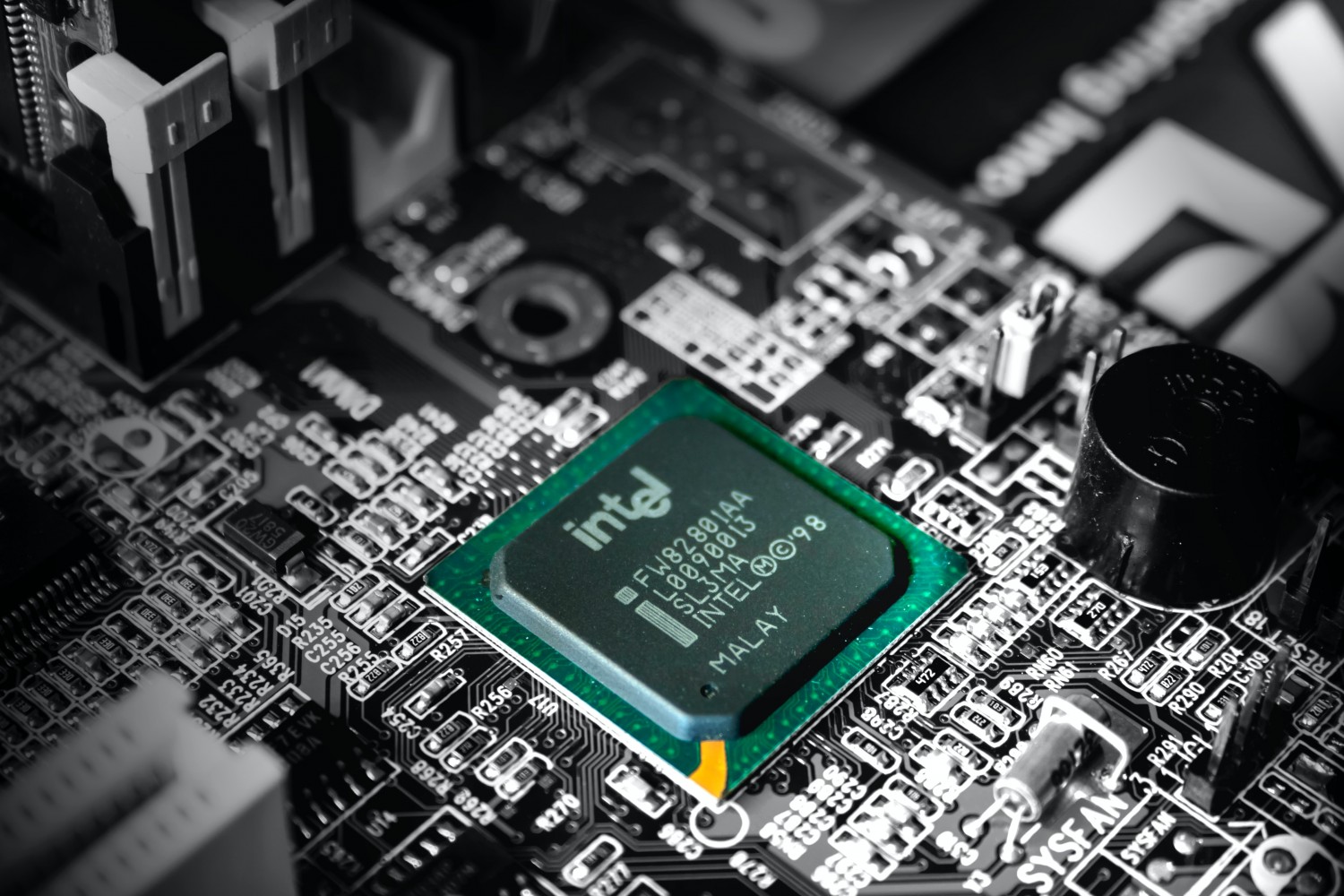

✔️ Tower Semiconductor, which is traded on the Nasdaq exchange, makes semiconductor components and integrated circuits used in automobiles, consumer devices, medical and industrial equipment. The company has manufacturing facilities in Israel and Japan, as well as in the states of California and Texas.

With its purchase, Intel hoped to strengthen its position in chip manufacturing, which is currently dominated by Taiwan Semiconductor Manufacturing Company (TSMC).

Tower Semiconductor has only a small presence in the custom chip market, but it has the necessary experience and customers, such as Broadcom Inc.

Heightened tensions between China and the U.S. have made it difficult to get regulatory approvals for deals, especially when it comes to semiconductor components.

Last year, DuPont de Nemours Inc. scuttled a proposed $5.2 billion acquisition of Rogers Corp. after failing to get timely clearance from Beijing. In 2018, US-based Qualcomm Inc. scrapped a $44 billion bid for Dutch chipmaker NXP Semiconductors NV after a drawn-out review by the State Administration for Market Regulation of China (SAMR).

Intel Chief Executive Pat Gelsinger had said he was trying to get the Tower deal approved by Chinese regulators and had visited the country as recently as last month to meet with government officials.

The deadline for completing the transaction was Aug. 15 at midnight in California.